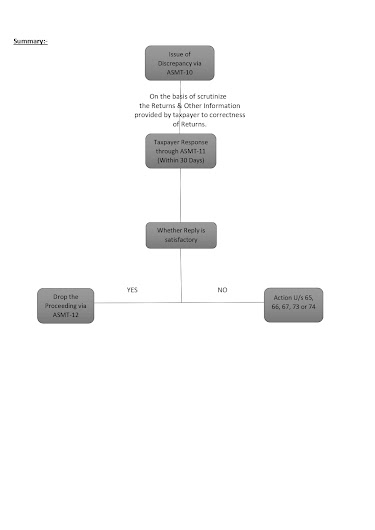

Scrutiny of Returns_ASMT-10

Related Section & Rule:- Section:- 61 Scrutiny of Returns. Rule :- 99 Scrutiny of Returns. What is GST ASMT-10:- As per Section 61 read with Rule 99 , a GST Officer is scrutinize the returns & related information furnished by the tax payer to verify the correctness of returns. If the assessment indicates a high risk of default or any indication of fraud, a scrutiny notice in the form of GST ASMT-10 is issued for seeking an explanation for the same. Tax Officer may indicate the same via SMS or Email registered with the department. GST ASMT-10 is merely a notice where discrepancies are found and intimated to the taxpayers. Hence there is no personal hearing in ASMT-10. ASMT-10 may specify the amount of tax, interest or any other amount payable by the taxpayer. Content of ASMT-10:- · Name, GST No. of Taxable Person & Tax Period for which discrepancies found. · Details about discrepancies PARA wise. · Details of the Tax