Interest Under the GST

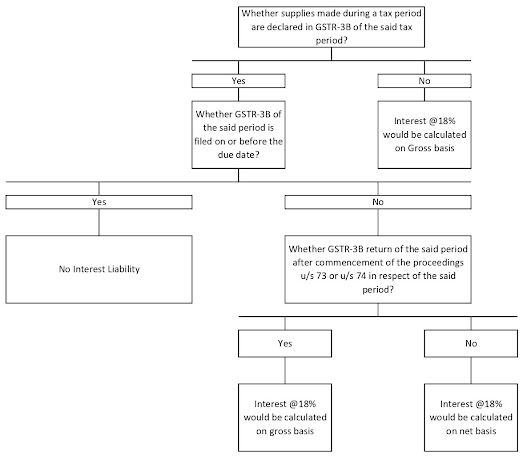

INTRODUCTION:- The Government of India has specified the due dates to pay Goods and Services Tax. The due date to pay GST is different for different types of taxpayers. If one fails to pay GST within the due date, one must pay the interest along with the GST dues for the delay period. RELEVANT SECTION & RULE:- Section:- Section 50 of CGST Act, 2017 Rule:- Rule 88B of CGST Rule, 2017. CIRCUMSTANCES WHEN INTEREST TO BE PAID:- 1) Interest related to GST on sales. (Section 50(1)) · Fails to pay such GST within the period as prescribed by GST Act, 2017 and Rules. · Makes short payment for the GST. 2) Interest related to ITC. (Section 50(3)) · Wrong ITC availed AND Utilized. · ITC availed AND Utilized over what they are eligible. RATE OF INTEREST:- 1) Interest related to GST on sales. :- 18% p.a. 2) Interest related to ITC.:- 24% p.a. INTEREST LEVY UNDER GST:-