Special procedure to be followed by a RP engaged in manufacturing of Pan Masala Etc.

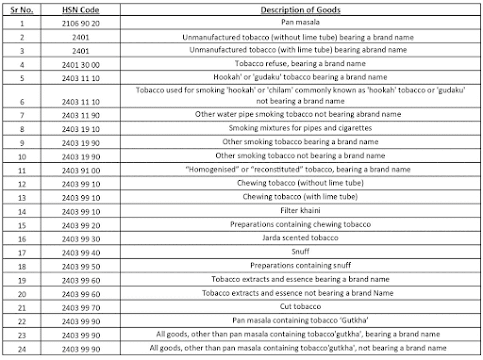

SPECIAL PROCEDURE TO BE FOLLOWED BY MANUFACTURING OF FOLLOWING GOODS (w.e.f. 01.01.2024) (Notification No. 47/2023_CT_25.09.2023): -

SPECIAL PROCEDURE: -

· Details of

Packing Machines: -

Form: - FORM SRM-I

Due Date: -

Within 30 days of issuance of this notification. (Date of Notification is

31.07.2023)

In case of New Registration after such notification: - Within fifteen days (15 Days) of grant of such

registration.

Headings of Form SRM-I: -

1.

Sr. No.

2.

Make and Model

No. of the Machine (including the name of manufacturer)

3.

Date of Purchase

of the Machine

4.

Address of place

of business where installed

5.

No. of Tracks

6.

Packing Capacity

of each track

7.

Total packing

capacity of machine

8.

Electricity

consumption by the machine per hour

9.

Supporting

Documents (Capacity certificate from Chartered Engineer)

10.

Unique ID of the

machine (to be auto populated)

· Production

capacity of his manufacturing unit or his machines has already submitted or

declared to any other government department or any other agency or

organization.

Form: - FORM SRM-IA

Due Date: - Within fifteen days (15 Days) of filing of said

declaration or submission.

If declaration

already submitted before the issuance of this notification: - Within 30 days of issuance of this notification.

(Date of Notification is 31.07.2023)

Headings of Form

SRM-IA: -

1.

Serial No.

2.

Name of Govt.

Department/ any other agency or organization

3.

Type of

Declaration/ Submission (copy of declaration to be uploaded on the portal)

4.

Details of

Declaration/Submission

·

If additional filling and packing machine being

installed in the registered place of business.

Form: - FORM SRM-IIA

Due Date: - within 24 hours of such installation.

Headings of Form

SRM-IIA: -

1.

Serial No.

2.

Make and Model

No. of the Machine (including the name of manufacturer)

3.

Date of Purchase

of the Machine

4.

Date of

installation of the Machine

5.

Address of place

of business where installed

6.

No. of Tracks

7.

Packing Capacity

of each track

8.

Total packing

capacity of machine

9.

Electricity

consumption by the machine per hour

10.

Supporting

Documents (Capacity certificate from Chartered Engineer)

11.

Unique ID of the

machine (to be auto populated)

Upon

furnishing of such details in FORM SRM-I or FORM SRM-IIA, a unique ID shall be

generated for each machine, whose details have been furnished by the registered

person, on the common portal.

·

Details of removal of the existing machines.

Form: - FORM SRM-IIB

Due Date: - within 24 hours of such removal.

Headings of Form

SRM-IIB: -

1.

Serial No.

2.

Unique ID of the

machine

3.

Make and Model

No. of the Machine (auto-populated)

4.

Date of Purchase

of the Machine (auto-populated)

5.

Address of place

of business from where the machine is removed. (auto-populated)

6.

No. of Tracks

(auto-populated)

7.

Packing Capacity

of each track (auto-populated)

8.

Total packing

capacity of machine (auto-populated)

9.

Date of Removal

10.

Reasons for removal/disposal

of the machine. (Sold to third party or Scrap)

·

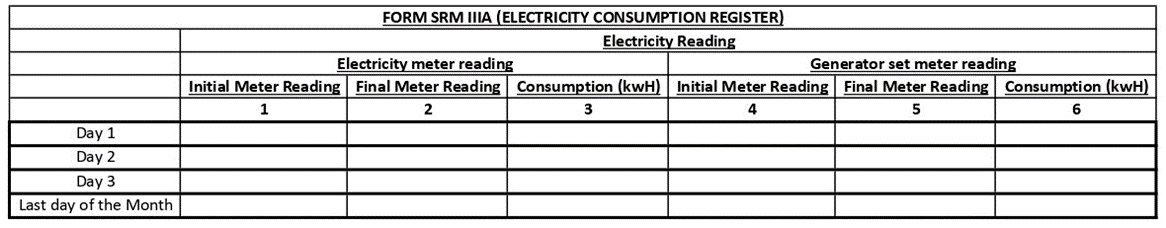

Additional records to be maintained by the

registered persons manufacturing the Specified goods.

1.

Input Register

& Electricity Reading in Form SRM-IIIA

2.

Production

Register in Form SRM-IIIB (Shift wise – Machine wise production – Product Wise

– Brand wise)

FORMATE OF FORM SRM-IIIA I.E. INPUT REGISTER &

ELECTRICITY READING.

FORMATE OF FORM SRM-IIIB I.E. PRODUCTION REGISTER.

·

Monthly statement.

Form: - FORM SRM-IV

Due Date: - on or before the tenth day (10th Day) of

the month succeeding such month.

Comments

Post a Comment